Cliff's Notes: The Chase is on

- Blog

- Cliff's Notes: The Chase is on

Cliff's Notes: The Chase is on

- By Cornerstone Wealth

- July 18, 2023

- 0

Cliff Hodge, CFA - Chief Investment Officer

Irrational exuberance is the psychological basis of a speculative bubble. I define a speculative bubble as a situation in which news of price increases spurs investor enthusiasm, which spreads by psychological contagion from person to person, in the process amplifying stories that might justify the price increases, and bringing in a larger and larger class of investors who, despite doubts about the real value of an investment, are drawn to it partly by envy of others' successes and partly through a gamblers' excitement.

- Robert Shiller, Irrational Exuberance Professor of Economics, Yale University.

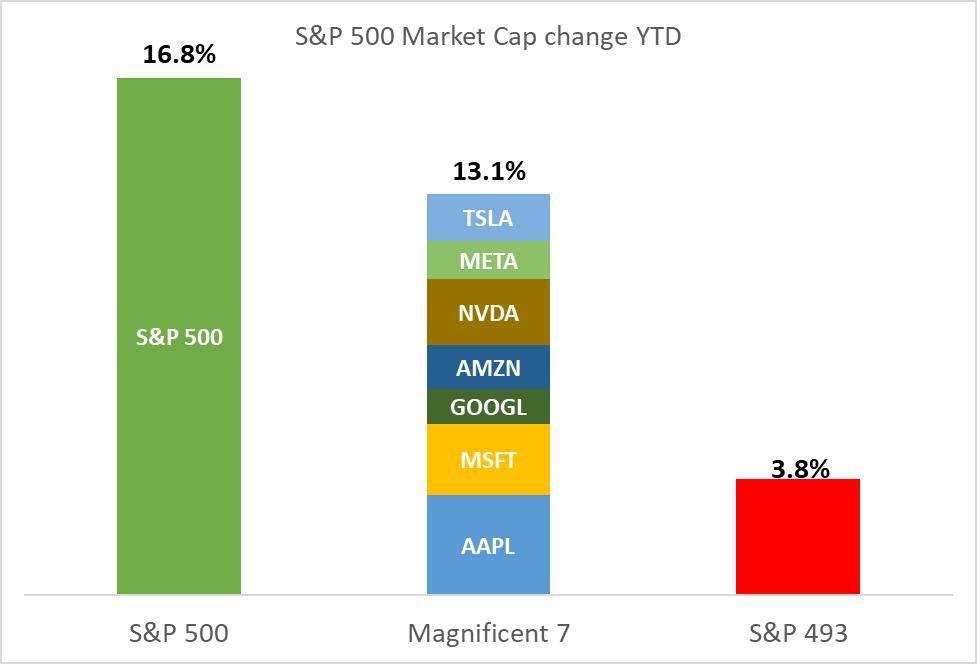

Halfway through 2023 equity markets are strong, as investors have latched on to the soft-landing (no recession) narrative and retail investors embrace a new found excitement for artificial intelligence (AI) and the “Magnificent 7”; a subset of seven mega-cap technology stocks consisting of Apple, Amazon, Tesla, Google, Meta, NVIDIA and Microsoft, which are all involved in AI to varying degrees. These seven stocks now account for 28% of the market cap of the S&P 500, a record for concentration.

As of June 30, the S&P 500 was up 16.8%, far exceeding Wall street’s expectations coming into 2023. When looking under the surface, however, the strength of these seven stocks masks lackluster returns for the broader market. Of the 16.8% return for the S&P 500 YTD, 13.1% or nearly 80% of the total was driven by gains in the “Magnificent 7”, while the S&P 493 (the S&P 500 excluding those seven) is up only a modest 3.8% YTD.

Source: Bloomberg and CWG calculations as of 6/30/2023

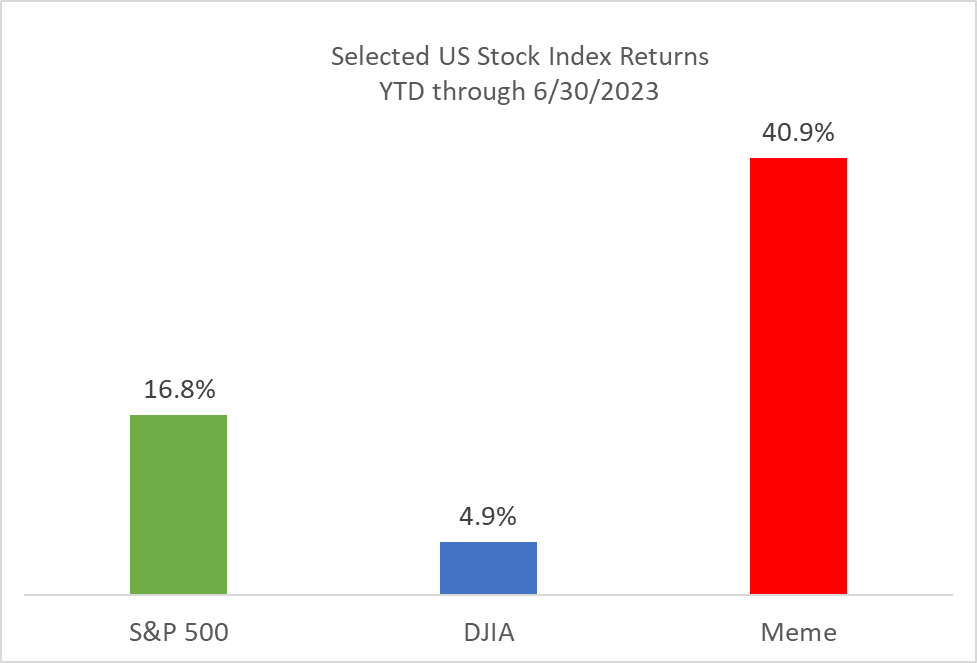

Another way to measure the irrational exuberance, we’re witnessing today is to compare the performance of the S&P 500, Dow Jones Industrial Average and the MEME index. The Meme index, also known as the Solactive Roundhill Meme Stock Index, is an index consisting of “25 equal-weighted U.S. listed equity securities that exhibit a combination of elevated social media activity and high short interest.” As it just so happens, the MEME index is up a whopping 41% YTD, all while the Fed continues on the fastest rate hiking cycle in 40 years and drains liquidity from the financial system. Investors can only ignore the math of valuations for so long before reality hits like a Mack truck!

Source: Bloomberg

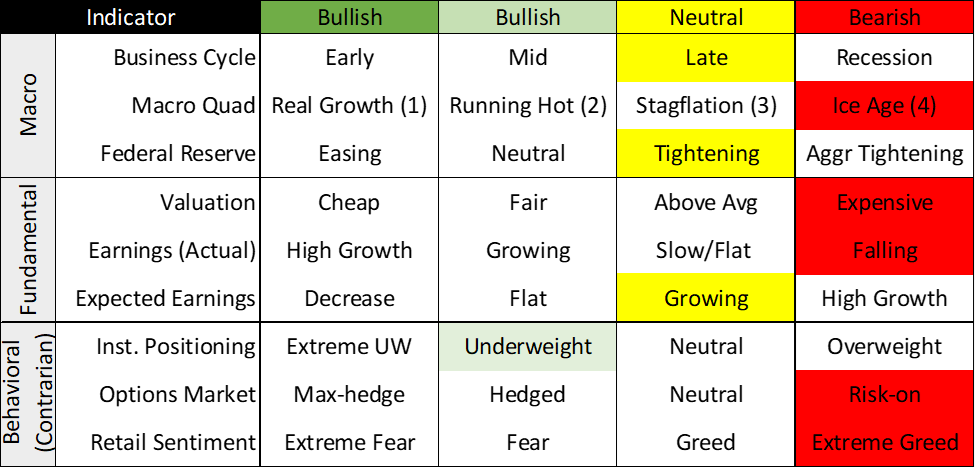

As you know, we’ve advocated for defensive positioning, as nearly all of our Dashboard (Macro, Fundamental, and Behavior) inputs signal (and continue to signal) that now is not the time to take additional risk. We continue to forecast a recession in the next 6-12 months, our Quad models indicate that the economy will enter consecutive QUAD 4 “Ice Age” periods, where growth and inflation slow simultaneously, all while the Fed continues to tighten policy via higher interest rates and Quantitative Tightening.

Fundamental and Behavioral inputs reinforce the story from a macro perspective, as valuations are expensive, especially compared to the level of interest rates, earnings are falling and investors are prioritizing FOMO (fear-of-missing-out) over rational analysis.

Source: CWG IM

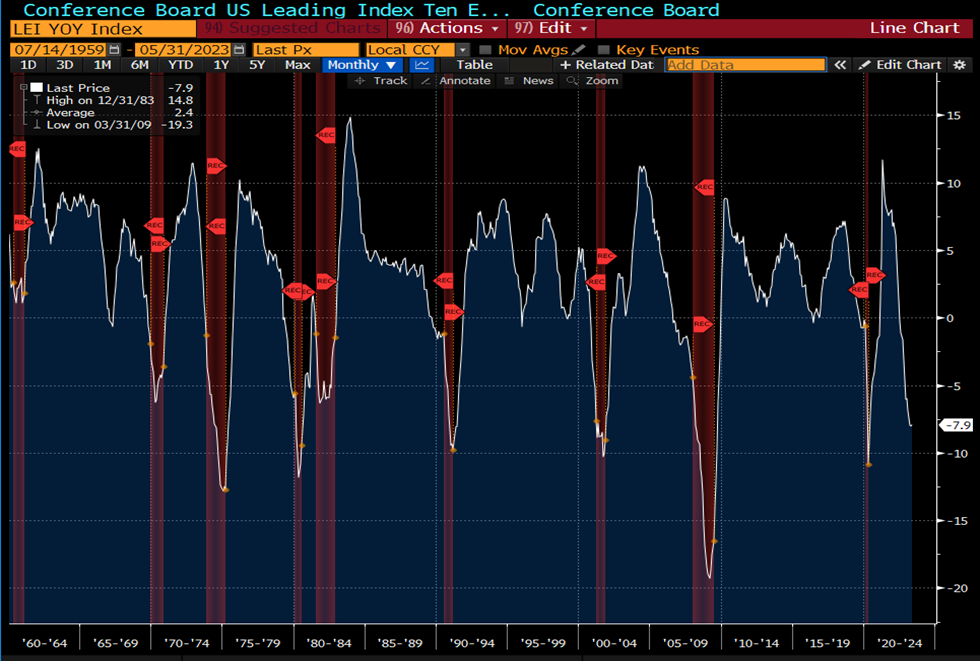

We’ll have much more macro information on our 3Q Webinar which is scheduled for July 27 at 4pm. Though I’ll leave readers with this snapshot from the Conference Board Leading Economic Index Indicator below, which has a perfect historical track record of predicting an oncoming recession at these levels. Could this time be different? Anything is possible but we’ll continue to side with history and our process!

Source: Bloomberg

While we don’t want to be dismissive of the emotional impacts of the markets, especially when FOMO rules the day, this is exactly why we follow a disciplined and data-driven investment process; a process that protected our clients to a greater extent in 2022 when the S&P 500 lost nearly 20%, and the bond market had its worst year on record. Remaining defensive in the face of strong markets which have completely detached from the macro and fundamentals can be painful in the short run, but investing is not a sprint that should be measured in weeks or months, but a marathon that should be measure in years or decades. History has shown time and time again that while irrational exuberance may take over for short periods, over the long-term fundamental reality always catches up. This time is no different.

Thanks for reading my note.

Cliff

Disclosures:

The S&P 500 Index, or the Standard & Poor's 500 Index, is a market-capitalization-weighted index of the 500 largest publicly-traded companies in the U.S. It is not an exact list of the top 500 U.S. companies by market capitalization because there are other criteria to be included in the index. The index is widely regarded as the best gauge of large-cap U.S. equities. Market indices are unmanaged and are not available for direct investment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue-chip stocks that are generally the leaders in their industry. It has been a widely followed indicator of the stock market since October 1, 1928. Market indices are unmanaged and are not available for direct investment.

This material provided by Cornerstone Wealth Group is for informational purposes only. It is not intended to serve as personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment. Any securities mentioned herein are not to be taken as advice or recommendation to buy or sell a specific security. The information provided may not be applicable to your account managed by Cornerstone Wealth Group. Please contact Cornerstone Wealth Group for specific information regarding the holdings and trading activity of your account. Opinions expressed in this commentary do not represent a personalized recommendation of a particular investment strategy to you. Additionally, you should review and consider any recent market news. All expressions of opinion are subject to change without notice in reaction to shifting market or other conditions. Data provided is believed to be accurate, but its accuracy, completeness or reliability cannot be guaranteed.

Investment advisory services offered through Cornerstone Wealth Group, LLC dba Cornerstone Wealth, an SEC registered investment adviser. Custody and other brokerage services provided to clients of Cornerstone Wealth Group, LLC dba Cornerstone Wealth are offered by Fidelity Brokerage Services LLC, Member NYSE/SIPC and Charles Schwab & Co., Inc., Member FINRA/SIPC.

Cliff's Notes - November 4, 2022

Contact Info

- Phone:704-987-3410

- Email: info@cwgadvisors.com

Web: cwgadvisors.com