Cliff's Notes - May, 2022

- Blog

- Cliff's Notes - May, 2022

Cliff's Notes - May, 2022

- By Cornerstone Wealth

- May 26, 2022

- 0

“It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.” – Mark Twain

|

Key Takeaways: The siren song of imminent recession continues to grow louder. Inflation is roaring, the Fed is tightening, and markets are volatile. We think that the now consensus view that recession is right around the corner is too early and wrong. While growth has peaked and is likely to slow, our economy is adding jobs at an incredibly high pace, the consumer is flush with cash and spending, and the industrial economy is accelerating. Historically all of these signals peak and turn negative before the economy falls into recession. We’re just not there. The risk/reward setup in equity markets is favorable for solid returns in the second half of 2022. |

With all the market volatility and increased calls for imminent recession, we wanted to provide our thoughts on where the macro economy stands, and most importantly why we are FADING the current consensus view that recession is right around the corner. The current narrative in the markets goes something like this. Due to 40-year-high inflation, the Fed is going to aggressively hike interest rates and reduce their balance sheet (Quantitative Tightening or QT), which will materially tighten financial conditions. The combination of higher prices for everyday necessities like gas, food, housing, other normal living expenses alongside higher financing costs for mortgages, auto loans, and credit cards are going to choke off the consumer so much in the next few months that the economy will fall into a recession. The slowdown in demand and increase in input costs will destroy corporate earnings, lead to higher unemployment, and crash the stock market. A bleak outlook no doubt. It’s no wonder that fear is palpable on Main Street as well as Wall Street.

The foundation of our investment process is data, and importantly how the data is changing. Today we share our top 3 reasons (data points) that the US avoids a recession in 2022 which are: jobs, the strength of the US consumer, and robust manufacturing. None of the data that we track are at levels commensurate with recession. Nor any of our market signals, outside of the sharp drop in stock prices. The movements in other assets do not support the recession narrative either. While it is true the economy has peaked from a growth rate perspective, and the markets have been extraordinarily volatile during the first few months of the year. We believe consensus has gotten too far ahead of itself in its pessimism, and imminent recessionary fears are overblown. We believe that market volatility creates opportunity, and at S&P 3900 the risk/reward setup is very attractive. This doesn’t mean the bottom is in, but the calls for a market crash are off based in our opinion. Most of the heavy lifting regarding valuations has already been done.

We’re at peak fear for inflation, hawkish Fed, and recession and we believe strongly that the second half of 2022 will be MUCH better for risk assets and our clients than the first. When the noise it at its loudest, we rely on data and most importantly TRUST OUR PROCESS!

Top 3 Reasons why we avoid recession in 2022

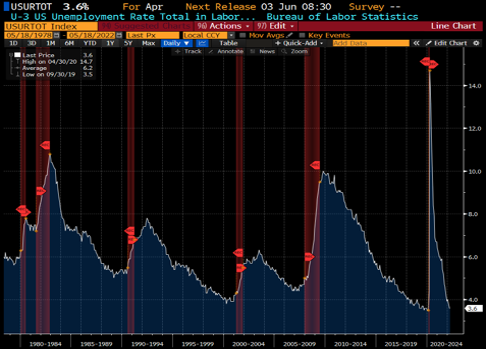

Our economy is still adding jobs at an incredibly high pace. There is a natural progression in the labor market that almost HAS to occur before the economy falls into a recession. First the pace of job gains peaks and slows, as the amount of job openings begin to contract and overall hiring slows down. Quit rates drop, as keeping a current job becomes more important than looking for better opportunities. Monthly job gains turn to losses, the amount of hours worked per week begins to decrease and the unemployment rate begins to rise. Then layoffs begin, and momentum in the unemployment rate picks up, and personal income falls for a time before recession. This process takes time and space to play out. Historically, when the unemployment rate rises by 0.5%, THAT becomes a key trigger for recession. Where do things stand today? Last month we ADDED 428,000 new jobs for the second month in a row, and unemployment rate remained at 3.6%, the LOWS of the cycle. There are 2 job openings for every unemployed person, quit rates are at highs and layoffs are nearly non-existent. The employment cycle is still in early innings.

Source: Bloomberg

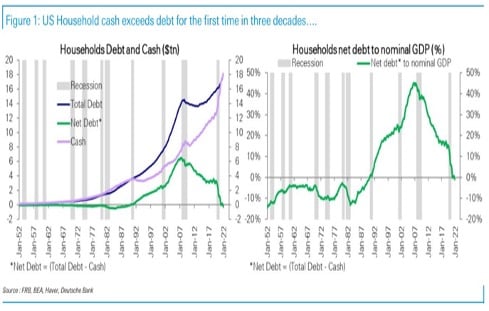

The US consumer is strong, has a clean balance sheet, and plenty of room to lever up. Historically recessions happen when consumers stop spending because they HAVE to. Savings are depleted, credit cards get maxed out and home equity loans have long been tapped. Spending shifts from wants, to the bare-essentials and a negative feedback loop ensues. The pullback in spending hits corporate profits which lead to more layoffs; a vicious recessionary spiral. Compare the recessionary scenario to today. Today we have the lowest debt service costs going back at least 40 years, and After accounting for the amount of cash households have today, Revolving credit jumped last month but has a long way to go before it becomes a problem. Consumers make up 70% of US GDP and have shown no signs of slowing down.

Source: Deutsche Bank

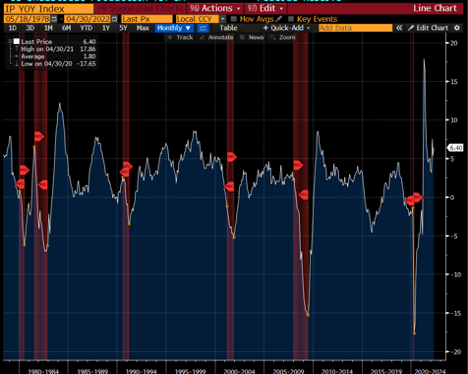

Industrial Production just hit an all-time high, and growth rates are robust! While the manufacturing economy is relatively small compared to consumption, the magnitude of changes shows us a lot about the state of the broader economy. Prior to every recession of the past 40 years, we’ve seen the industrial portion of the economy peak, slow down and then contract (drop below 0). While we’ve seen the rate of change in industrial production peak in our post pandemic economy, last month saw a re-acceleration in the year over year growth rate and put in a new all-time high. With the twin engines of the US consumer and manufacturing economy booming, it’s very difficult to see a rapid slowdown to cause a recession over the next year. Again, there is a natural progression that takes time and space to play out.

Source: Bloomberg

Source: Bloomberg

The bad news is that inevitably we will fall into recession. As most things in life and investing, it’s a matter of timing. We think fears of imminent recession are overblown for 2022. The real risk doesn’t manifest for at least another 18 months. Superior investment returns are earned betting against consensus when consensus is wrong. These opportunities are rare, but we believe now may be one of those times.

Thanks for reading my note.

Cheers,

Cliff

Disclosures:

The S&P 500 Index, or the Standard & Poor's 500 Index, is a market-capitalization-weighted index of the 500 largest publicly-traded companies in the U.S. It is not an exact list of the top 500 U.S. companies by market capitalization because there are other criteria to be included in the index. The index is widely regarded as the best gauge of large-cap U.S. equities. Market indices are unmanaged and are not available for direct investment

This material provided by Cornerstone Wealth Group is for informational purposes only. It is not intended to serve as personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment. Any securities mentioned herein are not to be taken as advice or recommendation to buy or sell a specific security. The information provided may not be applicable to your account managed by Cornerstone Wealth Group. Please contact Cornerstone Wealth Group for specific information regarding the holdings and trading activity of your account. Opinions expressed in this commentary do not represent a personalized recommendation of a particular investment strategy to you. Additionally, you should review and consider any recent market news. All expressions of opinion are subject to change without notice in reaction to shifting market or other conditions. Data provided is believed to be accurate, but its accuracy, completeness or reliability cannot be guaranteed.

Investment advisory services offered through Cornerstone Wealth Group, LLC dba Cornerstone Wealth, an SEC registered investment adviser. Custody and other brokerage services provided to clients of Cornerstone Wealth Group, LLC dba Cornerstone Wealth are offered by Fidelity Brokerage Services LLC, Member NYSE/SIPC and Charles Schwab & Co., Inc., Member FINRA/SIPC.

Cliff's Notes - November 4, 2022

Contact Info

- Phone:704-987-3410

- Email: info@cwgadvisors.com

Web: cwgadvisors.com