Inflation Protection Options: Insurance

- Blog

- Inflation Protection Options: Insurance

Inflation Protection Options: Insurance

- By CWG Advisors

- June 04, 2021

- 0

|

Inflation Protection Options

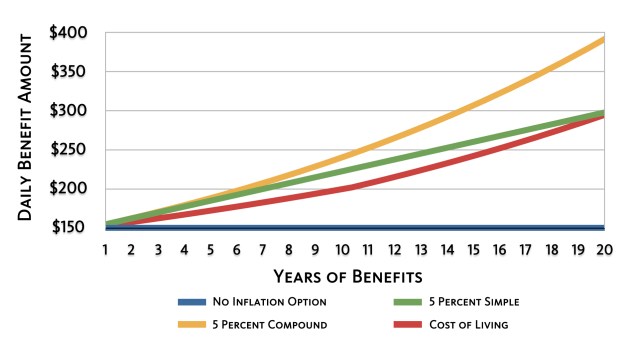

When you buy a long-term care insurance policy, you choose a daily benefit level (the amount that the policy will pay for your daily care if you need it), but it’s hard to know today what the future cost of care will be. Although the national average daily cost of a semi-private room in a nursing home is approximately $205, the cost may be much higher in your area, and may rise substantially in the future.*

An inflation rider automatically increases your benefit amount by a specific percentage each year, by either simple interest or compound interest. Cost-of-living inflation protection, usually pegged to the Consumer Price Index, is also available.

Five percent is a typical inflation factor. The chart above shows the effect of several different types of inflation riders:

|

No Inflation Option |

The straight blue line illustrates the daily benefit of a policy with a 5 percent compound inflation rider, which in later years will provide a significantly higher daily benefit than the percent simple option.

|

5 Percent Simple |

The green line shows the effect of 5 percent simple interest inflation protection. With this option, the daily benefit amount increases 5 percent per year.

|

5 Percent Compound |

The yellow line illustrates the daily benefit of a policy with a 5 percent compound inflation rider, which in later years will provide a significantly higher daily benefit than the percent simple option.

|

Cost of Living |

Finally, the red line shows the effect of a cost-of-living rider. For this illustration, it is assumed that the daily benefit amount increases at an annual rate of 3 percent for the first 10 years and 4 percent during years 11 through 20.

Visit cwgadvisors.com to learn more or reach us at 704-987-3410.

This is for informational purposes only and does not serve as personal advice. Please speak to a qualified representative about your own unique situation. Investment advisory services offered through Cornerstone Wealth Group, LLC dba Cornerstone Wealth, an SEC registered investment adviser.

Appropriate Checklist for Year-End Tax Planning

Risk Management - Disability Insurance for Young Professionals - CWG Advisors

Contact Info

- Phone:704-987-3410

- Email: info@cwgadvisors.com

Web: cwgadvisors.com

.png?width=180&height=138&name=Orange%20Bold%20Business%20Steps%20YouTube%20Thumbnail%20(1).png)