Cliff's Notes - July 29, 2022

- Blog

- Cliff's Notes - July 29, 2022

Cliff's Notes - July 29, 2022

- By CWG Advisors

- July 28, 2022

- 0

Cliff Hodge, CFA - Chief Investment Officer

While the most recent GDP reading marks two negative quarters of GDP growth, we’ll push back on the notion that the US economy is currently in a recession. The first quarter was marred by a widening trade deficit due to a surge in imports as the world continues to normalize from the pandemic. This quarter a slowdown in inventory accumulation tipped GDP growth mildly into the red. Neither of these readings provides much of an indication of the strength of the underlying economy. Personal consumption grew for the eighth straight quarter, rising 1% from last quarter. Looking at the gains in spending alongside continued strength in payrolls and it’s really difficult to call what we’re experiencing right now a recession.

The National Bureau of Economic Research (NBER) makes the official call for recession. It is widely held belief that two negative quarters of GDP growth automatically trigger a recession, but that’s just not the case. Fed Chairman Jerome Powell agreed with this assessment via his comments from the July FOMC press conference.

“I do not think the U.S. is currently in a recession and the reason is there are too many areas of the economy that are performing too well,” Powell said at a press conference following the Fed’s decision to raise rates by 0.75 percentage point for a second consecutive time. “This is a very strong labor market ... it doesn’t make sense that the economy would be in a recession with this kind of thing happening.”

I’ll side with Jay Powell on this one and reject the recession call. Rather than just focusing on the headline number, it’s worth digging into the growth rates of the components.

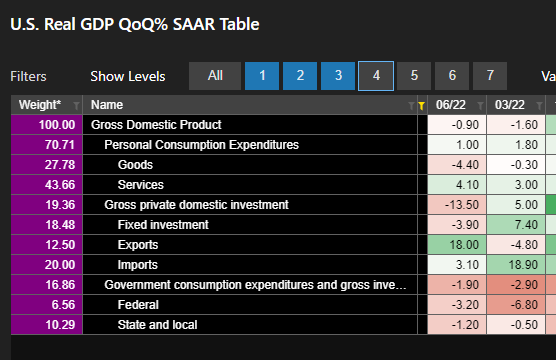

Source: Bloomberg

The first major takeaway is that Personal Consumption remained positive for 2Q, though it did decelerate from 1Q. The slowdown in goods spending was offset by an acceleration in services spending, a trend that we anticipated would play out. Consumers are continuing to hold up, though they are slowing down the pace of spending.

The major drag this quarter was related to Investment, and more specifically in this case inventories. It’s evident when you drill down into the key drivers as we do in the next graphic.

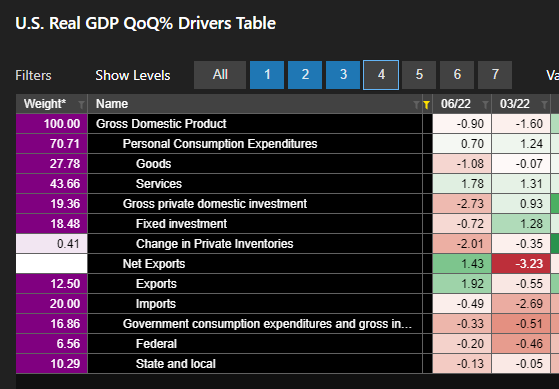

Source: Bloomberg

Inventories detracted 2% from the headline GDP number. Digging in even further we find that inventories actually increased by $118b in current dollars over the last quarter. It’s slower than the 1Q buildup of $238b, and due to the way GDP is calculated, actually counts as a subtraction to 2Q GDP growth. The trade issues that marred the 1Q report were partially offset in the most recent reading. A sign that global supply chain issues may be softening. Taking a more nuanced approach to the GDP release, it’s pretty clear that while the underlying economy is slowing, we have yet to hit a real recession.

Lastly, here’s the official recession definition from the NBER website. You’ll notice that the 2-quarter rule of thumb is not mentioned.

Q: What is a recession? What is an expansion?

A: The NBER's traditional definition of a recession is that it is a significant decline in economic activity that is spread across the economy and that lasts more than a few months. The committee's view is that while each of the three criteria—depth, diffusion, and duration—needs to be met individually to some degree, extreme conditions revealed by one criterion may partially offset weaker indications from another. For example, in the case of the February 2020 peak in economic activity, we concluded that the drop in activity had been so great and so widely diffused throughout the economy that the downturn should be classified as a recession even if it proved to be quite brief. The committee subsequently determined that the trough occurred two months after the peak, in April 2020. An expansion is a period when the economy is not in a recession. Expansion is the normal state of the economy; most recessions are brief. However, the time that it takes for the economy to return to its previous peak level of activity may be quite extended.

Source: https://www.nber.org/business-cycle-dating-procedure-frequently-asked-questions#:~:text=A%3A%20The%20NBER's%20traditional%20definition,more%20than%20a%20few%20months.

Hopefully, this more nuanced approach will help cut through the noise, which seems to grow louder by the day. Thanks for reading my note.

Cheers,

Cliff

Disclosures:

The S&P 500 Index, or the Standard & Poor's 500 Index, is a market-capitalization-weighted index of the 500 largest publicly-traded companies in the U.S. It is not an exact list of the top 500 U.S. companies by market capitalization because there are other criteria to be included in the index. The index is widely regarded as the best gauge of large-cap U.S. equities. Market indices are unmanaged and are not available for direct investment

This material provided by Cornerstone Wealth Group is for informational purposes only. It is not intended to serve as personalized investment advice or as a recommendation or solicitation of any particular security, strategy, or investment. Any securities mentioned herein are not to be taken as advice or recommendation to buy or sell a specific security. The information provided may not be applicable to your account managed by Cornerstone Wealth Group. Please contact Cornerstone Wealth Group for specific information regarding the holdings and trading activity of your account. Opinions expressed in this commentary do not represent a personalized recommendation of a particular investment strategy to you. Additionally, you should review and consider any recent market news. All expressions of opinion are subject to change without notice in reaction to shifting markets or other conditions. The data provided is believed to be accurate, but its accuracy, completeness, or reliability cannot be guaranteed.

Investment advisory services are offered through Cornerstone Wealth Group, LLC dba Cornerstone Wealth, an SEC-registered investment adviser. Custody and other brokerage services provided to clients of Cornerstone Wealth Group, LLC dba Cornerstone Wealth are offered by Fidelity Brokerage Services LLC, Member NYSE/SIPC, and Charles Schwab & Co., Inc., Member FINRA/SIPC.

Cliff's Notes - May 26, 2021 - CWG Advisors

Cliff's Notes - March 1, 2022

Contact Info

- Phone:704-987-3410

- Email: info@cwgadvisors.com

Web: cwgadvisors.com